Tax-advantaged health care planning for retirement

A Retirement Resource for Individuals and Families by Peter Stahl, CFP® Bedrock Business Results

Heading into retirement with confidence is easier if your planning includes steps to minimize taxes, especially as it relates to health care planning. Even though your income may decline in retirement, you still could be subject to high taxes and rising Medicare premiums.

Planning for retirement cannot be done without considering the costs associated with health care coverage, including Medicare. Understanding the basics of Medicare and creating financial goals for your future are critical first steps. (See my earlier paper, “Estimating Health Care and Medicare Costs in Retirement,” published by Guardian®.) There are a number of tangible steps you can take while accumulating retirement savings to put you in a better position to handle health care costs, including the onerous taxation of Medicare that affects some participants through the form of higher premiums.

2026 – Expenditures for major portions of Medicare are forecast to exceed revenues1

$28 trillion – In 2020, the U.S. national debt was in excess of $28 trillion dollars2

Higher Premiums – Retirees face taxes unique to retirement, such as the taxation of Social Security benefits and possible taxes in the form of higher Medicare premiums

Minimizing taxes in retirement can be a major advantage.

Types of income impacting medicare costs

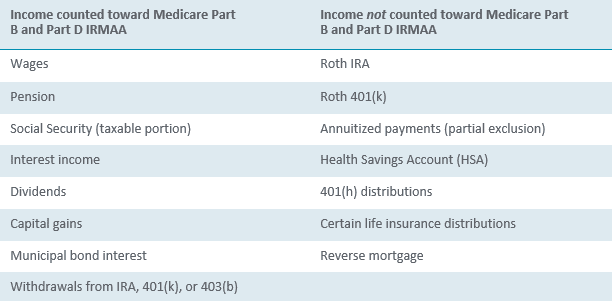

It’s important to understand which assets will generate taxable income — and which assets will not. More specifically, you need to understand what types of income may create higher premiums for Medicare Parts B and D. The Centers for Medicare and Medicaid Services refers to higher Medicare premiums as “Income Related Monthly Adjustment Amounts” or “IRMAA.”

Your Modified Adjusted Gross Income (MAGI) from two years ago will determine your current Part B and Part D premiums. In order to potentially lower your Medicare premiums, it’s important for you to understand which types of income are included in MAGI and which are not.

There are a few items in each column that usually catch people by surprise. The first is your Social Security benefit. If your income reaches certain levels, you will pay ordinary income tax on the benefit. The taxable portion of the benefit can also push you into higher Medicare premiums. The other item that may surprise you is the inclusion of tax-free municipal bond interest in the Medicare IRMAA calculation.

The largest bind comes from many who accumulate the majority of their investable assets in qualified retirement plans (such as IRAs, 401(k), and 403(b) plans). The challenge is two-fold. First, distributions from these accounts are taxed as ordinary income. Second, distributions are mandatory at age 72 and may increase with each passing year. If these required distributions bump you into a higher Medicare premium, the result will be tens of thousands of dollars in additional costs over the course of your retirement.

The obvious consideration, from looking at this list, is to make sure you are accumulating assets in investments that will provide a tax-free cash flow during retirement. Not all of the items in the list above are available to everyone (e.g., your employer may only offer traditional 401(k), not a Roth 401(k)), nor is each item appropriate for everyone. However, a retirement portfolio that includes a Roth account, a Health Savings Account (HSA), and an annuity may help your tax situation.

Roth accounts

Roth accounts should play a meaningful role in retirement planning. Roths provide an account in which earnings accumulate without taxation. They then allow tax-free withdrawals during retirement. Another significant advantage for using Roths as part of your retirement savings plan is that Roth distributions do not count toward your Modified Adjusted Gross Income (MAGI) in determining Medicare premiums.

There are primarily three ways to accumulate wealth with a Roth account:

- Contribute to a Roth IRA

- Convert a traditional IRA to a Roth IRA

- Contribute to a Roth 401(k) within an employer-sponsored plan

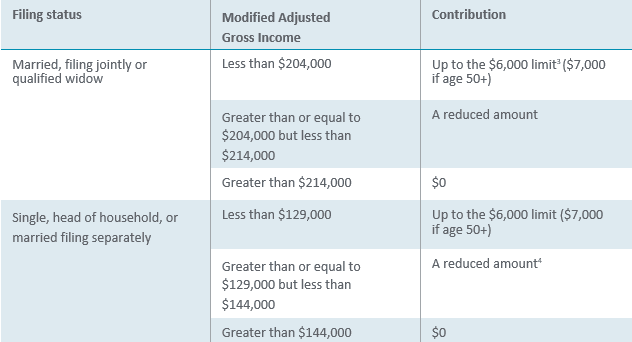

Whether or not you’re allowed to contribute to a Roth IRA is based on your income (more specifically, your MAGI).If you file a joint federal tax return in 2022, and your income is under $204,000, or if you file a single return and your income is under $129,000, you will be able to make a full Roth contribution. As your income gets above these levels, the amount you can contribute will lower and goes away completely at certain income levels.

2022 Roth IRA contribution limits:

- $6,0003

- Extra $1,000 for those age 50 or older (catch-up contribution)

2022 income limits to determine Roth eligibility4

Roth accounts should play a meaningful role in most retirement savings plans.

The power of Roth IRA

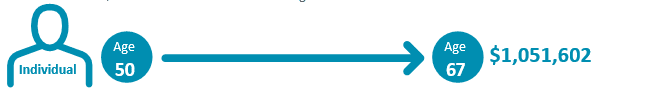

Looking at the example below, one can better gauge how important a Roth IRA can be to a retirement savings plan — as an individual or as a couple. The retirement distributions illustrated here are income tax free and will not create higher Medicare IRMAA premiums. This is what makes the Roth IRA a powerful retirement savings planning tool.

This hypothetical illustration assumes each individual contributes $7,000 per year through their retirement age, shown here as age 67. This illustration also assumes an 8% annualized rate of return. In 17 years, the Roth IRA would accumulate to over $250,000 for the individual and over $500,000 for the couple. This money, when distributed, will be income tax free and Medicare IRMAA tax free. That is a great advantage during one’s retirement years.

Roth 401(k)

Though not as widely utilized as a traditional 401(k) plan, the Roth 401(k) provides a tremendous planning opportunity. Like traditional 401(k) contributions, Roth 401(k) contributions are made directly from your paycheck. You’re provided a list of approved investment choices and your money (and its investment earnings, if any) accumulates without current taxation. Note that employer matches are placed into a traditional 401(k) account, since these contributions will be taxable upon distribution.

Two major differences between a Roth 401(k) and a traditional 401(k) are:

- Roth contributions are not tax deductible.

- Qualified Roth distributions are income tax 5

2022 Roth 401(k) contribution limits:

- $20,500

- Extra $6,500 for those age 50 or older (catch-up contribution)

The power of a Roth 401(k)

There are many factors that many individuals feel may point to higher taxes in the years ahead. The projected insolvency of Medicare and resulting tax increase is just one reason why forgoing current deductions in order to build a true tax-free cash flow with the Roth makes sense.

This hypothetical illustration assumes an individual fully funds their Roth 401(k) by contributing $26,000 each year from age 50 to age 67. This illustration also assumes an 8% annualized rate of return. In 17 years, the Roth 401(k) would accumulate to over $1 million. Retirement distributions to the individual will be income tax free and Medicare IRMAA tax free. If there was also a company match and an increase in the contribution limit, the accumulation could be even greater.

Roth conversions

For those who earn too much to make a Roth contribution or do not have a Roth 401(k) available in the workplace, there is yet another way to accumulate wealth in a Roth account. This method is available to individuals, regardless of income, and involvement in employer- sponsored plans. Individuals have the ability each year to convert existing IRAs into Roth IRAs. The idea is to pay taxes today on the IRA that you decide to convert, in order to create a tax-free cash flow in retirement. This may be prudent if you believe that taxes in retirement will be higher than they are today. When estimating your future taxes, remember to account for taxes that are unique to your retirement years, such as taxes on Medicare and Social Security. I advise working closely with your financial professional and accountant to determine if a full or partial conversion of your IRA assets may make sense for you.

In summary, by forgoing the current tax deduction offered by traditional IRAs and 401(k)s and using Roth accounts, you may be able to reduce your taxes in retirement. This should increase the amount and extend the longevity of your retirement income. You may wish to make the Roth an important part of your retirement asset accumulation plan. Make sure to explore each of these options with your financial advisor and tax professional.

The Health Savings Account (HSA)

An HSA provides a means of creating a tax-free cash flow to pay for current and future qualified medical health care expenses. HSAs are used in conjunction with high deductible health plans (HDHPs). With a high deductible plan, you pay out of pocket for your health care expenses, up to a certain amount, before insurance begins to pay.

An HSA is an account into which you place money to be used for your non-covered health care expenditures.

The primary benefits of an HSA include:

- Personal contributions are fully tax. 6

- Distributions from the account for qualified health expenditures are tax.

- The funds in an HSA can be invested.

- Unused funds continue to grow, free from taxes (it’s not “use it or lose it” annually, as with a Flexible Spending Account or FSA).

- The account belongs to you even if you change employers or retire.

- Some employers will make a contribution to your account.

HSAs were established by federal law in December 2003 with the enactment of the Medicare Prescription Drug, Improvement, and Modernization Act. In 2020, an HDHP must have an annual deductible of at least $1,400 for self-only coverage and at least $2,800 for family coverage. There are additional provisions that an insurance policy must follow in order to make the plan HSA eligible. Be sure to confirm with your employer or insurance provider that your plan is HSA eligible. If you withdraw money from the HSA for something other than a qualified medical expense, you will pay a 20% penalty tax on the distribution. Once you reach age 65, the 20% penalty is waived.

2022 HSA contribution limits

- $7,300 for a family

- $3,650 for an individual

- Those age 55 and over can contribute an additional $1,000 per year.

- Any employer contributions are included in these limits.

HSA qualified health care expenditures

HSA distributions are tax free when used for qualified health expenses. The list of qualified health expenses is extensive (for a full list, consult your plan provider). Generally speaking, if the expense is created by a legitimate health care need, it’s probably on the list of qualified expenditures. In addition to doctor visits, copays, deductibles, and prescription drugs, the following items are classified as qualified distributions:

- Vision care (eyeglasses, contacts, Lasik surgery)

- Dental work

- Orthopedic shoes

- Hearing aids

- Therapy equipment

- Long term care insurance premiums (with limits)

- Medicare premiums for Parts A, B, C, D

The power of an HSA

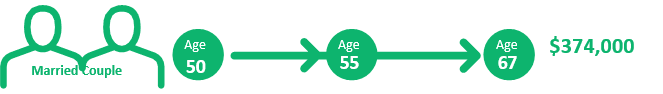

Consider a 50-year-old married couple who maximizes their annual HSA contributions, refrains from taking any money out of the HSA, and invests the funds.

This hypothetical illustration assumes a married couple at age 50 begins saving their maximum HSA contributions each year, including their catch-up contribution from age 55 on. This illustration also assumes a 2% increase to the HSA annual contribution limit, and an 8% annualized rate of return. Given these assumptions, the HSA would grow to $374,000.

It is important to realize that in this example, the couple was choosing to pay for qualified medical expenses with non-HSA funds until retirement. This allowed the HSA to stay invested and grow. You should keep track of these expenditures, as they can be used at any time over your life span to justify tax-free distributions from the HSA.

If the couple’s financial needs change after age 65, and the funds are withdrawn for something other than medical expenses, there are no penalties, just ordinary income taxes due on amounts withdrawn.

An HSA provides a means of creating a tax-free cash flow to pay for current and future qualified medical health care expenses in retirement.

Annuities

Understanding how investments are taxed and utilizing investments that allow you greater control can be a significant part of planning for health care costs in retirement. Annuities that offer tax deferral, tax-favored income, opportunity for growth, and lifetime income guarantees can play meaningful roles in one’s retirement strategy.

Money invested in an annuity grows tax deferred (meaning you do not get taxed while your earnings accumulate within the annuity). When you decide to take systematic or periodic distributions from an annuity during retirement, you will only pay taxes on the income you withdraw. You are not taxed on the full amount of gains in the annuity; you only pay taxes on the amount you choose to take out.

Annuities that offer tax deferral, tax-favored income, opportunity for growth, and lifetime income guarantees can play meaningful roles in one’s retirement strategy.

One effective planning strategy is to use a non-qualified annuity for a portion of your investment dollars. This can be particularly useful for those who reach age 72 and are forced to take distributions out of their qualified accounts (primarily IRAs). These distributions are called required minimum distributions or RMDs. So, while you’re taking RMDs from your qualified accounts, it can be helpful to have non-qualified (non-IRA) money in an annuity, allowing interest and earnings that you are not spending to accumulate without current taxation.

In other words, use the taxable cash flow from your IRA and other taxable investments to meet your spending needs and reduce your tax liability (including Medicare premiums) by keeping a portion of your non-IRA money (especially monies for which are you not spending the earnings) in the annuity.

Another way to utilize an annuity is to consider taking the income with an annuitized cash flow. In this situation, the annuity company provides you an income stream, usually based on your life expectancy, in which a portion of the payment is taxable, and a portion is non-taxable. Generally, the income stream is guaranteed for your lifetime. The benefit, in addition to helping you plan for longevity, is a tax-favored cash flow. Annuitization offers partial tax relief and helps alleviate the fear of outliving your retirement savings.

Preparing for your financial future

The cost of health care worries many people today. Pre-retirees increasingly cite the cost of health care as their top financial concern for retirement. Three core strategies for tax-advantaged health care planning and a tax-favored cash flow in retirement include the use of Roth accounts, an HSA, and annuities.

The bind that many investors face is created by accumulating almost all of one’s retirement savings in qualified accounts. The RMDs on these accounts at age 72 have the potential to push you into higher income taxes and higher Medicare premiums. A better approach to obtain greater after-tax income during retirement is to utilize Roths, HSAs, and non- qualified annuities along with your qualified plan savings.

Additional strategies such as a 401(h) for small business owners, reverse mortgages, and life insurance loans should also be discussed with a financial professional. However, the core strategies outlined in this paper for using a Roth, an HSA, and an annuity are the most common steps individuals can take to position their retirement savings to deal with health care costs in a tax-favored manner. Whether you are accumulating wealth for retirement or managing income during retirement, be sure to take the time to review the benefits and costs of this approach with your tax and financial professionals.

Using a Roth, an HSA, and an annuity are the most common steps individuals can take to position their retirement savings to deal with health care costs in a tax-favored manner.

The Guardian Life Insurance Company of America guardianlife.com New York, NY

EB017930 (01/22)

2022-132273 (Exp. 01/24)

This piece was created with the help of Peter Stahl, a Certified Financial Planner™ with over 30 years of experience. He delivers training and resources across the United States, making navigating through a complex and ever-changing health care landscape comprehensible to all. Peter founded Bedrock Business Results LLC, a consulting firm, and WealthWatch, an online resource center providing content on retirement health issues (www.yourwealthwatch.com). He is the author of “Top of the First: The Convergence of Health Care and Financial Planning.”