The ABCs of financial literacy

So you think you know what it means to be financially literate? See if your knowledge stands up against this infographic.

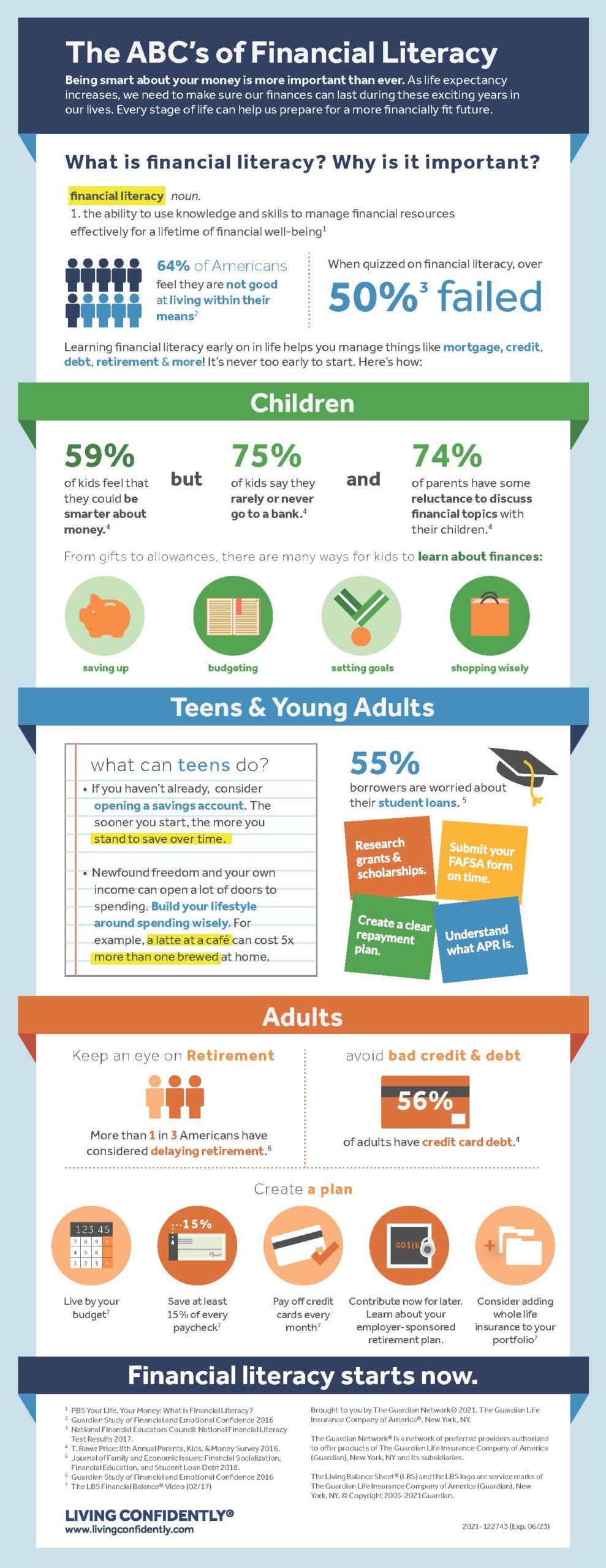

The ABC’s of Financial Literacy

Being smart about your money is more important than ever. As life expectancy increases, we need to make sure our finances can last during these exciting years in our lives. Every stage of life can help us prepare for a more financially fit future.

What is financial literacy? Why is it important?

Financial literacy noun.

- the ability to use knowledge and skills to manage financial resources effectively for a lifetime of financial well-being1

[Graphic of ten people with six dark blue and four light blue]

64% of Americans feel they are not good at living within their means2

When quizzed on financial literacy, over [blue bold text 50%3 failed]

Learning financial literacy early on in life helps you manage things like mortgage, credit, debt, retirement & more! It’s never too early to start. Here’s how:

[Graphic of a green banner with the word children in the center]

59% of kids feel that they could be smarter about money.4

but

75% of kids say they rarely or never go to a bank.4

and

74% of parents have some reluctance to discuss financial topics with their children.4

From gifts to allowances, there are many ways for kids to learn about finances:

[Graphic of a piggybank] saving up

[Graphic of a ledger] budgeting

[Graphic of a gold medal] setting goals

[Graphic of a shopping bag] shopping wisely

[Graphic of a blue banner that says Teens & Young Adults in the center]

What can teens do?

If you haven’t already, consider opening a savings account. The sooner you start, the more you stand to save over time.

Newfound freedom and your own income can open a lot of doors to spending. Build your lifestyle around spending wisely. For example, a latte at a café can cost 5x more than one brewed at home.

[Graphic of a graduation cap]

55% of borrowers are worried about their student loans.5

[Graphic of an orange square that says Research grants & scholarships.]

[Graphic of a yellow square that says Submit your FAFSA forms on time.]

[Graphic of a green square that says Create a clear repayment plan.]

[Graphic of a blue square that says Understand what APR is.]

[Graphic of an orange banner that says adults in the center]

Keep an eye on Retirement

[Graphic of three people with one being light orange and two dark orange]

More than 1 in 3 Americans have considered delaying retirement.6

Avoid bad credit & debt

[Graphic of an orange credit card with the number 56%] of adults have credit card debt.4

Create a plan

[Graphic of a calculator] Live by your budget7

[Graphic of a paycheck] Save at least 15% of every paycheck7

[Graphic of a credit card with a checkmark over it] Pay off credit cards every month7

[Graphic of a square saying 401k with a padlock over it] Contribute now for later. Learn about your employer-sponsored retirement plan.

[Graphic of three file folders with a plus sign beside them] Consider adding whole life insurance to your portfolio7

[Graphic of a blue banner that says Financial literacy starts now in the center]

1 PBS Your Life, Your Money: What is Financial Literacy?

2 Guardian Study of Financial and Emotional Confidence 2016

3 National Financial Educators Council: National Financial Literacy Test Results 2017.

4 T. Rowe Price: 8th Annual Parents, Kids, & Money Survey 2016.

5 Journal of Family and Economic Issues: Financial Socialization, Financial Education, and Student Loan Debt 2018.

6 Guardian Study of Financial and Emotional Confidence 2016

7 The LBS Financial Balance® Video (02/17)

Brought to you by The Guardian Network© 2021. The Guardian Life Insurance Company of America®, New York, NY.

The Guardian Network® is a network of preferred providers authorized to offer products of The Guardian Life Insurance Company of America (Guardian), New York, NY and its subsidiaries.

The Living Balance Sheet® (LBS) and the LBS logo are service marks of The Guardian Life Insurance Company of America (Guardian), New York, NY. © Copyright 2005-2021Guardian

LIVING CONFIDENTLY®

www.livingconfidently.com

2021-122743 (Exp. 06/23)