Health care costs in retirement

[Image of a man and woman eating breakfast]

Health care costs in retirement

Make a plan for a confident future

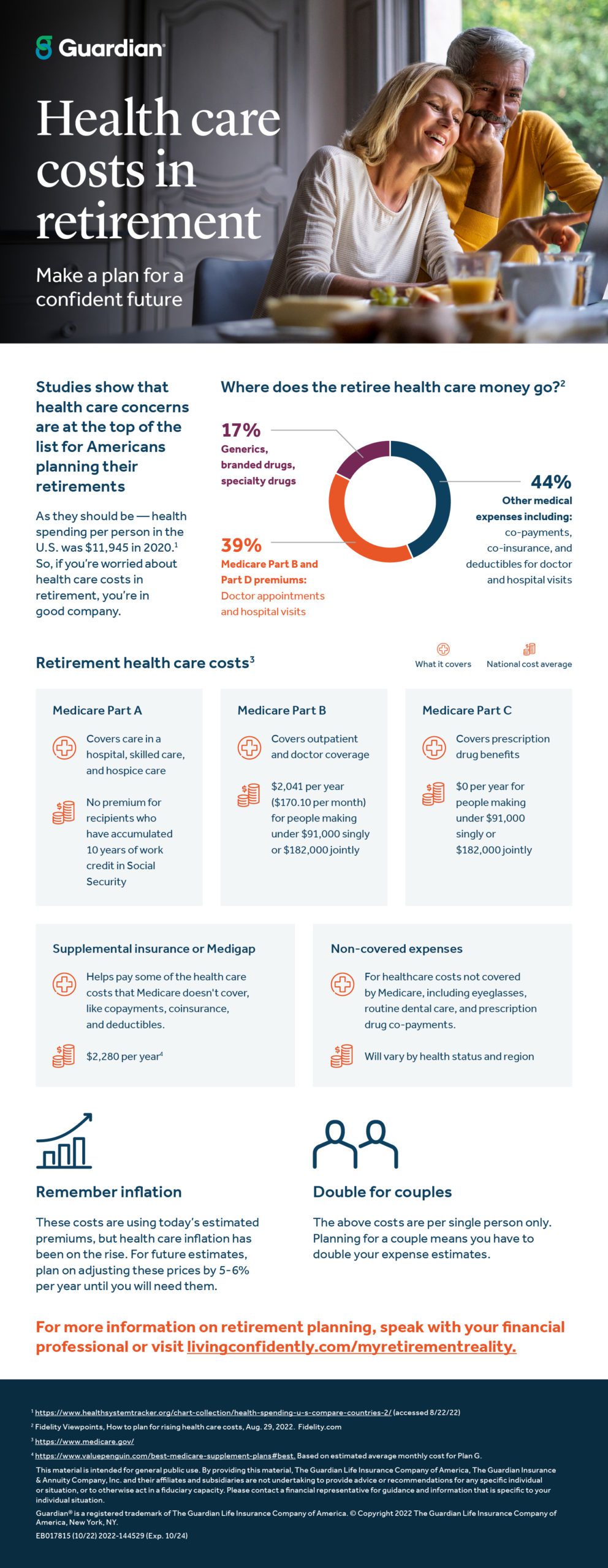

Studies show that health care concerns are at the top of the list for Americans planning their retirements As they should be — health spending per person in the U.S. was $11,945 in 2020.1 So, if you’re worried about health care costs in retirement, you’re in good company.

Where does the retiree health care money go?2

[Graphic of circle chart with three sections noted by different colors broken

- Purple portion: 17% – Generics, branded drugs, specialty drugs

- Orange portion: 39% – Medicare Part B and Part D premiums: Doctor appointments and hospital visits

- Blue portion: 44% Other medical expenses including: co-payments, co-insurance, and deductibles for doctor and hospital visits

Retirement health care costs3

[Graphic of circle with plus mark]

What it covers

[Graphic of two piles of coins with dollar symbol]

National cost average

Medicare Part A

[Graphic of circle with plus mark]

Covers care in a hospital, skilled care, and hospice care

[Graphic of two piles of coins with dollar symbol]

No premium for recipients who have accumulated 10 years of work credit in Social Security

Medicare Part B

[Graphic of circle with plus mark]

Covers outpatient and doctor coverage

[Graphic of two piles of coins with dollar symbol]

$2,041 per year ($170.10 per month) for people making under $91,000 singly or $182,000 jointly

[Graphic of circle with plus mark]

Medicare Part C Covers prescription drug benefits

[Graphic of two piles of coins with dollar symbol]

$0 per year for people making under $91,000 singly or $182,000 jointly

Supplemental insurance or Medigap

[Graphic of circle with plus mark]

Helps pay some of the health care costs that Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

[Graphic of two piles of coins with dollar symbol]

$2,280 per year4

Non-covered expenses

[Graphic of circle with plus mark]

For healthcare costs not covered by Medicare, including eyeglasses, routine dental care, and prescription drug co-payments.

[Graphic of two piles of coins with dollar symbol]

Will vary by health status and region

[Graphic of bar chart with arrow above pointing upward]

Remember inflation These costs are using today’s estimated premiums, but health care inflation has been on the rise. For future estimates, plan on adjusting these prices by 5-6% per year until you will need them.

[Graphic representing the torso and head of two people]

Double for couples

The above costs are per single person only. Planning for a couple means you have to double your expense estimates.

For more information on retirement planning, speak with your financial professional or visit livingconfidently.com/myretirementreality.

1 https://www.healthsystemtracker.org/chart-collection/health-spending-u-s-compare-countries-2/ (accessed 8/22/22)

2 Fidelity Viewpoints, How to plan for rising health care costs, Aug. 29, 2022. Fidelity.com

4 https://www.valuepenguin.com/best-medicare-supplement-plans#best. Based on estimated average monthly cost for Plan G.

This material is intended for general public use. By providing this material, The Guardian Life Insurance Company of America, The Guardian Insurance & Annuity Company, Inc.and their affiliates and subsidiaries are not undertaking to provide advice or recommendations for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact a financial representative for guidance and information that is specific to your individual situation.

Guardian® is a registered trademark of The Guardian Life Insurance Company of America. © Copyright 2022 The Guardian Life Insurance Company of America, New York, NY. EB017815 (10/22) 2022-144529 (Exp. 10/24)