Whole•istic Thinking

Whole life insurance is one of the key ingredients to living confidently.

Understanding and owning whole life insurance correlates with higher financial and emotional confidence.

Whole Life Insurance at a Glance:

1.5X

48%

3X

78%

83%

The most confident American workers are more than 1.5 times likely to own whole life insurance

of households need more life insurance

Life insurance costs 3 times less than most people think

of working Americans do not completely understand whole life insurance

of working Americans place a priority on providing for their family if they die or are unable to work

Whole Life Insurance at a Glance:

The Whole Truth: Benefits of Whole Life Insurance

Many working Americans identify their top life priorities as protecting their family, having enough money in retirement, and educating their children.

Did you know that owners of whole life insurance have access to a wide range of benefits to support those priorities?

Benefits

- Guaranteed death benefit protection to help ensure a legacy[1]

- Guaranteed living benefits such as cash value that can be applied toward things like the purchase of a new home, funding education or a business, supplementing retirement income, and charitable giving[2]

- Guaranteed premiums that won’t change, once the policy is in force[3]

- Potential dividend payments and additional growth[4]

- Built-in tax advantages on both the cash value and death benefit[5]

- Protection from disability or illness through the election of optional riders[6]

- Protection from creditors, depending on your state[7]

Whole Life Myths vs. Facts

Take the mystery out of whole life.

MYTH: The whole life policy you own can increase in cost as you age or become ill and the premiums will go on forever.

FACT: Whole life premiums are guaranteed to never increase once the policy is purchased. There are various policy designs that can avoid “forever” premium payments.

MYTH: Whole life is expensive.

FACT: While whole life costs more than term life, it includes many additional living benefits, such as cash value. Plus, it has a permanent death benefit, while you may outlive a term life death benefit.

MYTH: Term life is a better option for most people.

FACT: Whole life offers permanent lifetime protection, while term offers only temporary protection. Consequently, people may use both for optimal protection and benefits.

MYTH: People rarely use the living benefits of whole life when they’re alive.

FACT: Many people use the living benefits of whole life as a source for cash.

An Alternative Asset Class

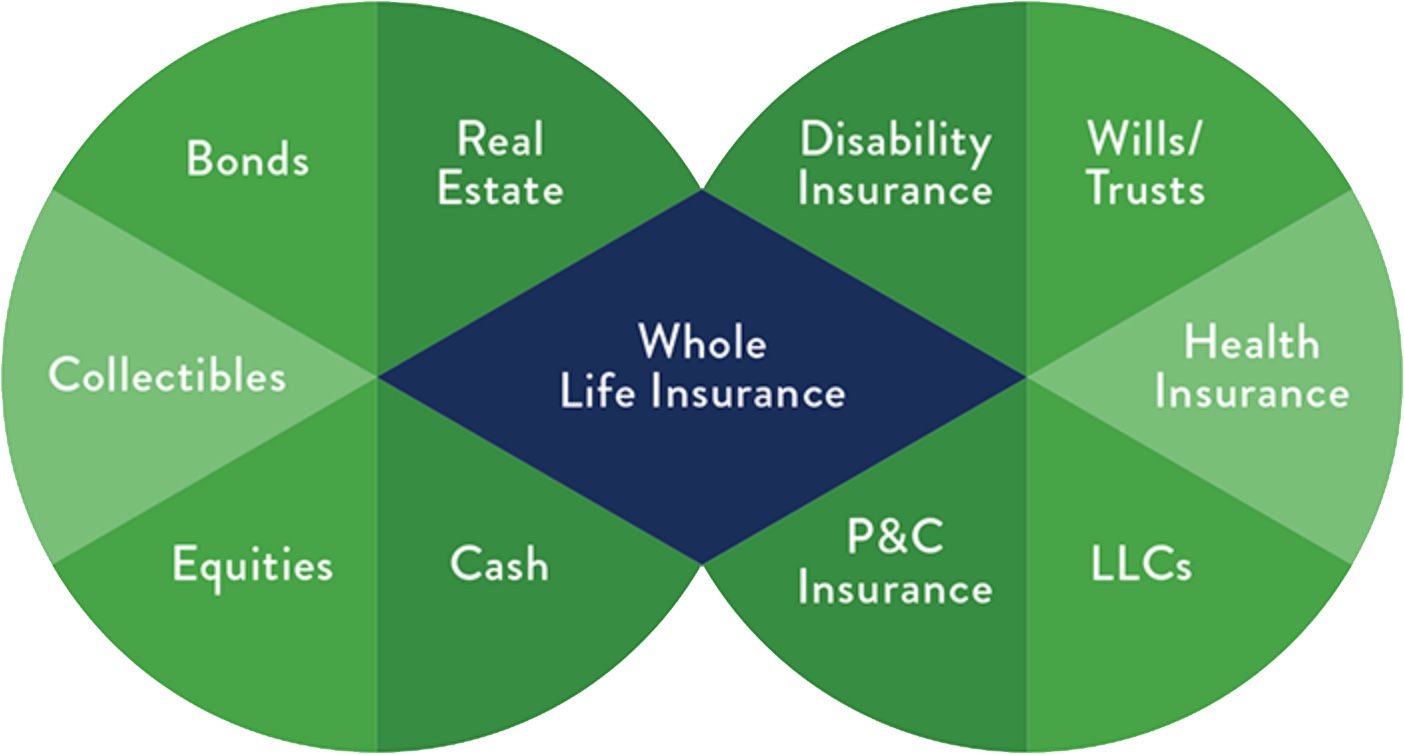

Did you know that whole life is considered an asset class that can help diversify your portfolio?

The cash value in a whole life insurance policy can help you manage risk when combined with a mix of fixed assets (like bonds) and equity assets (like stocks). Additionally, it’s insulated from market volatility, potentially increasing rewards. So, it’s there when you need it — now, or in the future.

Find out how whole life insurance can help reduce overall portfolio risk and protect portfolio performance, potentially increasing reward.

LEARN MOREHow much protection is right for you?

While term insurance can protect you in the short-term, the right amount of whole life protection you may want depends on where you are in life, who depends on you, and your earning potential. Generally speaking, the younger you are, the more years of income you may need to take into account when deciding on the right policy amount for you.

The Importance of Protection First

What does protection first mean? While saving for retirement and paying down debt is important, it shouldn’t come at the expense of adequate protection and coverage for you and your family. The most financially confident Americans are more likely to prioritize protection and own the right tools to help get the job done.[8]

Start Building Your Whole Story

There’s more to whole life insurance than you may already know. Check out our whole life resources page to find out more about the ways it can help you live with greater financial and emotional confidence.

If you choose life insurance from a mutual versus a stock company, you’ll know that the company’s long-term interests are aligned with yours as a policyholder.

Start Building Your Whole Story

There’s more to whole life insurance than you may already know. Check out our whole life resources page to find out more about the ways it can help you live with greater financial and emotional confidence.

If you choose life insurance from a mutual versus a stock company, you’ll know that the company’s long-term interests are aligned with yours as a policyholder.

Speak with your financial professional about whole life insurance and start living more confidently.

FIND A FINANCIAL PROFESSIONALSources & Important Disclosures.