Of course you’ve heard of life insurance, and maybe you’ve heard of celebrity body part insurance, but have you heard of zombie apocalypse insurance? It seems that wherever there is a concern, whether real, imagined, or just plain nuts, there is an insurance product to address it. Here is your handy A to Z guide chronicling the various types of insurance floating around out there.

- Alien abduction insurance. If you’re worried about being snatched by extra-terrestrials, there’s insurance for that. More than 30,000 policies have been written. 1

- Asteroid and meteor insurance. It’s available, but unfortunately it won’t protect you from all those awful late-night movies about asteroids and meteors.

- Auto insurance. The first auto policy was issued in 1897. Perhaps because stop signs and traffic signals weren’t introduced until 20 years later.2

- Bed bug insurance. As if having bed bugs weren’t bad enough, most homeowner’s policies won’t cover costs for extermination or new furnishings, for example.

- Body part insurance. A singer’s vocal cords, a soccer player’s legs, and a guitarist’s famous middle finger (seriously) are some examples of how stars protect their livelihoods.

- Business insurance. In addition to property, liability, and worker’s comp coverage, many businesses are now adding data breach policies to guard against hackers.

- Change of heart insurance. Also called “cold feet” insurance, this policy will reimburse a third party for the costs of a wedding if the bride or groom calls it off a year in advance.

- Chicken insurance. With more people raising ducks, pigs, goats, and chickens in their backyards, specialty policies now cover all manner of “pet” livestock.

- Dental insurance. Take care of your teeth and they’ll take care of you. Poor oral health is linked to diabetes, heart disease, and stroke.

- Disability insurance. A young person entering the workforce today has a 25 percent chance of becoming disabled before retirement. Disability insurance can be a lifeline when income is lost.3

- Fantasy football insurance. Protects the fantasy team “owner” if a player gets injured. By the way, fantasy football costs employers over $13 billion in lost productivity.4 (Where’s the insurance for that?)

- Ghost insurance. Some companies will protect you against being permanently disabled by a ghost. Proving it might be tough.

- Haunted house insurance. Dim lights. Open flames. Sudden frights. Halloween haunted houses can cause a nightmare of personal injuries, which is why most carry liability policies.

- Health insurance. Inability to pay medical bills is the primary cause of personal bankruptcy. Make it a priority in your budget and look for the best coverage you can afford.

- Hole-in-one insurance. If you make a one-in-a-million shot, golf tournament organizers get lucky too, as long as they have a policy to cover the cost of the new car you just won.

- Homeowner’s insurance. The top five home claims? Wind damage, water damage from faulty plumbing, hail, weather-related water damage, and theft.

- Life insurance. A high-tech billionaire recently bought the world’s most valuable life insurance policy worth $201 million.5 But even thousand-aires can benefit from such protection.

- Loch Ness Monster insurance. A company is offering $1.5 million to anyone capturing the legendary Nessie alive, and they’ve taken out a policy to cover their losses. So far, no takers.6

- Lottery insurance. You own a small business. Half of your workers win a huge lottery and quit. This policy will help cover your costs of hiring new people. Preferably non-gamblers.

- Multiple birth insurance. Paging a certain formerly eligible bachelor. Couples blind-sided by twins, triplets, or more babies can get coverage to handle the extra costs.

- Pet insurance. Pet owners spent over $15 billion on veterinary care in America in 2014, but less than one percent of the nation’s 171 million dogs and cats are covered by pet insurance.7

- Pirate insurance. Piracy pays, just ask the legendary captain of the Black Pearl. Pirates cost ship owners upwards of $16 billion a year, and insurance can help cover costs for hull damage, kidnapping, and ransom.8

- Renter’s insurance. Many renters believe a landlord’s insurance will cover them in the event of property loss or damage. Wrong. Get a renter’s policy. It’s highly affordable.

- Tuition insurance. If a student withdraws from college or university due to medical reasons or a death in the family, tuition insurance can help recover lost tuition and related expenses.

- Zombie apocalypse insurance. Whether it’s zombies, werewolves, or vampires on the loose, these policies have you covered.

While there are certainly a few insurance types here that many would consider, well, gratuitous, there are others that are a smart move, life and disability among them. The takeaway: expect the unexpected, and get protected.

Brought to you by The Guardian Network © 2017, 2022. The Guardian Life Insurance Company of America®, New York, NY.

2022-148126 Exp. 12/24

As a small business owner, you’re used to having to rely on yourself for everything from retirement planning to health insurance. Saving for your children’s college fund is no different. It may seem like a daunting task, yet there are strategies you can use to help fund your children’s education.

Business owners and financial aid

A couple owns a small hometown retail store. Over the years, it’s done well—expanding, hiring locals, and contributing to the local economy. Everyone is proud of the couple’s success—especially since the business is worth more than $1 million. Now that it’s time for college for the couple’s children, the parents are concerned that the success of their business means their children won’t qualify for financial aid.

Thanks to legislation that took effect in 2006, family-controlled businesses have options. If your business has 100 or fewer employees, you may still qualify for financial aid if you meet certain income requirements and if most of your assets are tied up in the business.

This couple has 30 employees and the main value of the business is in the retail location they own and their inventory. Their child ends up qualifying for limited financial aid, and they may even end up with the ability to claim an American Opportunity Tax Credit of up to $2,500 for their eligible student.

Consult a knowledgeable financial professional to determine your eligibility for financial aid. Paying for college becomes much easier when financial aid and tax breaks are involved.

Hiring your kids

To support her young son, a single mother opens an employment agency. After eight years, the business is doing well and her 13-year-old son comes in three times a week to help with office tasks like filing and light cleaning. The single mother pays her son an hourly wage in line with local wages, and a portion of those earnings can go toward his college fund.

To the extent that your child has a tax liability, your children are in lower tax brackets, and that can mean an overall advantage. You get a tax break for paying your children, lowering your income, and your children can use their earnings to save for college or other goals.

Work with an experienced financial professional to ensure that what you pay your child (earned income) helps them avoid the “kiddie” tax.

Another way to benefit your children who work in your business is to set up an educational assistance plan. If you have a written plan, you may be able to deduct some of your child’s education costs. Just make sure you understand additional requirements, such as offering this option to other employees and obeying limits on the benefits paid. A couple with a successful restaurant business must offer the educational assistance to the entire waitstaff—not just their own kids.

Tax-advantaged college savings

A man decides to start driving for Uber part-time in order to earn extra money for his two children’s college educations. After doing some research, he realizes that his state offers a tax deduction for contributions to a 529 savings plan. When he contributes everything he earns from his Uber earnings toward his children’s 529 plans, his side hustle becomes a state tax deduction.

Tax-advantaged accounts like a 529 plan help you save for your children’s education over time. Depending on your state, and the plan you use, you can qualify for a state tax deduction when you contribute to a 529, although there is no federal tax deduction. The money is tax-free to your child when the funds are withdrawn to pay for qualified education expenses.

If you fund a 529 with your child’s earnings, that can make your money more efficient over time. The single mother paying her son for administrative tasks, or the couple with the hometown retail store, can pay their children and use a portion of the money to boost the tax efficiency of their college funds.

It’s also possible to use cash value life insurance as a vehicle for saving for your child’s education. With the right planning, cash value can be more flexible than a 529.1

You want to give your child the best start in life. And, as a small business owner, you have several options available to save for educational expenses.

Brought to you by The Guardian Network © 2019, 2021. The Guardian Life Insurance Company of America.

2021-127488 Exp. 9/2023

A Retirement Resource for Individuals and Families by Peter Stahl, CFP® Bedrock Business Results

Heading into retirement with confidence is easier if your planning includes steps to minimize taxes, especially as it relates to health care planning. Even though your income may decline in retirement, you still could be subject to high taxes and rising Medicare premiums.

Planning for retirement cannot be done without considering the costs associated with health care coverage, including Medicare. Understanding the basics of Medicare and creating financial goals for your future are critical first steps. (See my earlier paper, “Estimating Health Care and Medicare Costs in Retirement,” published by Guardian®.) There are a number of tangible steps you can take while accumulating retirement savings to put you in a better position to handle health care costs, including the onerous taxation of Medicare that affects some participants through the form of higher premiums.

2026 – Expenditures for major portions of Medicare are forecast to exceed revenues1

$28 trillion – In 2020, the U.S. national debt was in excess of $28 trillion dollars2

Higher Premiums – Retirees face taxes unique to retirement, such as the taxation of Social Security benefits and possible taxes in the form of higher Medicare premiums

Minimizing taxes in retirement can be a major advantage.

Types of income impacting medicare costs

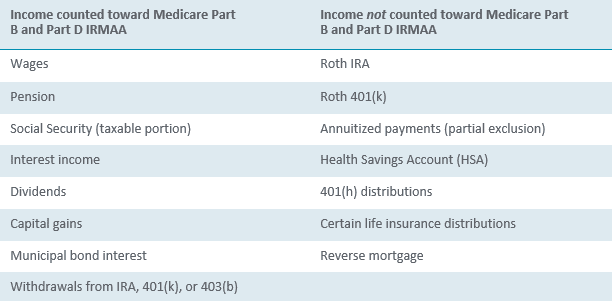

It’s important to understand which assets will generate taxable income — and which assets will not. More specifically, you need to understand what types of income may create higher premiums for Medicare Parts B and D. The Centers for Medicare and Medicaid Services refers to higher Medicare premiums as “Income Related Monthly Adjustment Amounts” or “IRMAA.”

Your Modified Adjusted Gross Income (MAGI) from two years ago will determine your current Part B and Part D premiums. In order to potentially lower your Medicare premiums, it’s important for you to understand which types of income are included in MAGI and which are not.

There are a few items in each column that usually catch people by surprise. The first is your Social Security benefit. If your income reaches certain levels, you will pay ordinary income tax on the benefit. The taxable portion of the benefit can also push you into higher Medicare premiums. The other item that may surprise you is the inclusion of tax-free municipal bond interest in the Medicare IRMAA calculation.

The largest bind comes from many who accumulate the majority of their investable assets in qualified retirement plans (such as IRAs, 401(k), and 403(b) plans). The challenge is two-fold. First, distributions from these accounts are taxed as ordinary income. Second, distributions are mandatory at age 72 and may increase with each passing year. If these required distributions bump you into a higher Medicare premium, the result will be tens of thousands of dollars in additional costs over the course of your retirement.

The obvious consideration, from looking at this list, is to make sure you are accumulating assets in investments that will provide a tax-free cash flow during retirement. Not all of the items in the list above are available to everyone (e.g., your employer may only offer traditional 401(k), not a Roth 401(k)), nor is each item appropriate for everyone. However, a retirement portfolio that includes a Roth account, a Health Savings Account (HSA), and an annuity may help your tax situation.

Roth accounts

Roth accounts should play a meaningful role in retirement planning. Roths provide an account in which earnings accumulate without taxation. They then allow tax-free withdrawals during retirement. Another significant advantage for using Roths as part of your retirement savings plan is that Roth distributions do not count toward your Modified Adjusted Gross Income (MAGI) in determining Medicare premiums.

There are primarily three ways to accumulate wealth with a Roth account:

- Contribute to a Roth IRA

- Convert a traditional IRA to a Roth IRA

- Contribute to a Roth 401(k) within an employer-sponsored plan

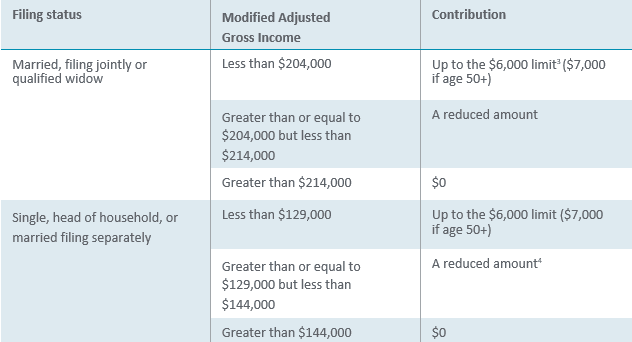

Whether or not you’re allowed to contribute to a Roth IRA is based on your income (more specifically, your MAGI).If you file a joint federal tax return in 2022, and your income is under $204,000, or if you file a single return and your income is under $129,000, you will be able to make a full Roth contribution. As your income gets above these levels, the amount you can contribute will lower and goes away completely at certain income levels.

2022 Roth IRA contribution limits:

- $6,0003

- Extra $1,000 for those age 50 or older (catch-up contribution)

2022 income limits to determine Roth eligibility4

Roth accounts should play a meaningful role in most retirement savings plans.

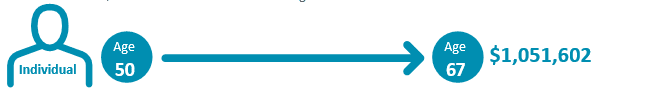

The power of Roth IRA

Looking at the example below, one can better gauge how important a Roth IRA can be to a retirement savings plan — as an individual or as a couple. The retirement distributions illustrated here are income tax free and will not create higher Medicare IRMAA premiums. This is what makes the Roth IRA a powerful retirement savings planning tool.

This hypothetical illustration assumes each individual contributes $7,000 per year through their retirement age, shown here as age 67. This illustration also assumes an 8% annualized rate of return. In 17 years, the Roth IRA would accumulate to over $250,000 for the individual and over $500,000 for the couple. This money, when distributed, will be income tax free and Medicare IRMAA tax free. That is a great advantage during one’s retirement years.

Roth 401(k)

Though not as widely utilized as a traditional 401(k) plan, the Roth 401(k) provides a tremendous planning opportunity. Like traditional 401(k) contributions, Roth 401(k) contributions are made directly from your paycheck. You’re provided a list of approved investment choices and your money (and its investment earnings, if any) accumulates without current taxation. Note that employer matches are placed into a traditional 401(k) account, since these contributions will be taxable upon distribution.

Two major differences between a Roth 401(k) and a traditional 401(k) are:

- Roth contributions are not tax deductible.

- Qualified Roth distributions are income tax 5

2022 Roth 401(k) contribution limits:

- $20,500

- Extra $6,500 for those age 50 or older (catch-up contribution)

The power of a Roth 401(k)

There are many factors that many individuals feel may point to higher taxes in the years ahead. The projected insolvency of Medicare and resulting tax increase is just one reason why forgoing current deductions in order to build a true tax-free cash flow with the Roth makes sense.

This hypothetical illustration assumes an individual fully funds their Roth 401(k) by contributing $26,000 each year from age 50 to age 67. This illustration also assumes an 8% annualized rate of return. In 17 years, the Roth 401(k) would accumulate to over $1 million. Retirement distributions to the individual will be income tax free and Medicare IRMAA tax free. If there was also a company match and an increase in the contribution limit, the accumulation could be even greater.

Roth conversions

For those who earn too much to make a Roth contribution or do not have a Roth 401(k) available in the workplace, there is yet another way to accumulate wealth in a Roth account. This method is available to individuals, regardless of income, and involvement in employer- sponsored plans. Individuals have the ability each year to convert existing IRAs into Roth IRAs. The idea is to pay taxes today on the IRA that you decide to convert, in order to create a tax-free cash flow in retirement. This may be prudent if you believe that taxes in retirement will be higher than they are today. When estimating your future taxes, remember to account for taxes that are unique to your retirement years, such as taxes on Medicare and Social Security. I advise working closely with your financial professional and accountant to determine if a full or partial conversion of your IRA assets may make sense for you.

In summary, by forgoing the current tax deduction offered by traditional IRAs and 401(k)s and using Roth accounts, you may be able to reduce your taxes in retirement. This should increase the amount and extend the longevity of your retirement income. You may wish to make the Roth an important part of your retirement asset accumulation plan. Make sure to explore each of these options with your financial advisor and tax professional.

The Health Savings Account (HSA)

An HSA provides a means of creating a tax-free cash flow to pay for current and future qualified medical health care expenses. HSAs are used in conjunction with high deductible health plans (HDHPs). With a high deductible plan, you pay out of pocket for your health care expenses, up to a certain amount, before insurance begins to pay.

An HSA is an account into which you place money to be used for your non-covered health care expenditures.

The primary benefits of an HSA include:

- Personal contributions are fully tax. 6

- Distributions from the account for qualified health expenditures are tax.

- The funds in an HSA can be invested.

- Unused funds continue to grow, free from taxes (it’s not “use it or lose it” annually, as with a Flexible Spending Account or FSA).

- The account belongs to you even if you change employers or retire.

- Some employers will make a contribution to your account.

HSAs were established by federal law in December 2003 with the enactment of the Medicare Prescription Drug, Improvement, and Modernization Act. In 2020, an HDHP must have an annual deductible of at least $1,400 for self-only coverage and at least $2,800 for family coverage. There are additional provisions that an insurance policy must follow in order to make the plan HSA eligible. Be sure to confirm with your employer or insurance provider that your plan is HSA eligible. If you withdraw money from the HSA for something other than a qualified medical expense, you will pay a 20% penalty tax on the distribution. Once you reach age 65, the 20% penalty is waived.

2022 HSA contribution limits

- $7,300 for a family

- $3,650 for an individual

- Those age 55 and over can contribute an additional $1,000 per year.

- Any employer contributions are included in these limits.

HSA qualified health care expenditures

HSA distributions are tax free when used for qualified health expenses. The list of qualified health expenses is extensive (for a full list, consult your plan provider). Generally speaking, if the expense is created by a legitimate health care need, it’s probably on the list of qualified expenditures. In addition to doctor visits, copays, deductibles, and prescription drugs, the following items are classified as qualified distributions:

- Vision care (eyeglasses, contacts, Lasik surgery)

- Dental work

- Orthopedic shoes

- Hearing aids

- Therapy equipment

- Long term care insurance premiums (with limits)

- Medicare premiums for Parts A, B, C, D

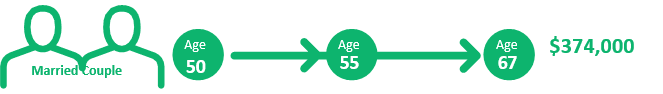

The power of an HSA

Consider a 50-year-old married couple who maximizes their annual HSA contributions, refrains from taking any money out of the HSA, and invests the funds.

This hypothetical illustration assumes a married couple at age 50 begins saving their maximum HSA contributions each year, including their catch-up contribution from age 55 on. This illustration also assumes a 2% increase to the HSA annual contribution limit, and an 8% annualized rate of return. Given these assumptions, the HSA would grow to $374,000.

It is important to realize that in this example, the couple was choosing to pay for qualified medical expenses with non-HSA funds until retirement. This allowed the HSA to stay invested and grow. You should keep track of these expenditures, as they can be used at any time over your life span to justify tax-free distributions from the HSA.

If the couple’s financial needs change after age 65, and the funds are withdrawn for something other than medical expenses, there are no penalties, just ordinary income taxes due on amounts withdrawn.

An HSA provides a means of creating a tax-free cash flow to pay for current and future qualified medical health care expenses in retirement.

Annuities

Understanding how investments are taxed and utilizing investments that allow you greater control can be a significant part of planning for health care costs in retirement. Annuities that offer tax deferral, tax-favored income, opportunity for growth, and lifetime income guarantees can play meaningful roles in one’s retirement strategy.

Money invested in an annuity grows tax deferred (meaning you do not get taxed while your earnings accumulate within the annuity). When you decide to take systematic or periodic distributions from an annuity during retirement, you will only pay taxes on the income you withdraw. You are not taxed on the full amount of gains in the annuity; you only pay taxes on the amount you choose to take out.

Annuities that offer tax deferral, tax-favored income, opportunity for growth, and lifetime income guarantees can play meaningful roles in one’s retirement strategy.

One effective planning strategy is to use a non-qualified annuity for a portion of your investment dollars. This can be particularly useful for those who reach age 72 and are forced to take distributions out of their qualified accounts (primarily IRAs). These distributions are called required minimum distributions or RMDs. So, while you’re taking RMDs from your qualified accounts, it can be helpful to have non-qualified (non-IRA) money in an annuity, allowing interest and earnings that you are not spending to accumulate without current taxation.

In other words, use the taxable cash flow from your IRA and other taxable investments to meet your spending needs and reduce your tax liability (including Medicare premiums) by keeping a portion of your non-IRA money (especially monies for which are you not spending the earnings) in the annuity.

Another way to utilize an annuity is to consider taking the income with an annuitized cash flow. In this situation, the annuity company provides you an income stream, usually based on your life expectancy, in which a portion of the payment is taxable, and a portion is non-taxable. Generally, the income stream is guaranteed for your lifetime. The benefit, in addition to helping you plan for longevity, is a tax-favored cash flow. Annuitization offers partial tax relief and helps alleviate the fear of outliving your retirement savings.

Preparing for your financial future

The cost of health care worries many people today. Pre-retirees increasingly cite the cost of health care as their top financial concern for retirement. Three core strategies for tax-advantaged health care planning and a tax-favored cash flow in retirement include the use of Roth accounts, an HSA, and annuities.

The bind that many investors face is created by accumulating almost all of one’s retirement savings in qualified accounts. The RMDs on these accounts at age 72 have the potential to push you into higher income taxes and higher Medicare premiums. A better approach to obtain greater after-tax income during retirement is to utilize Roths, HSAs, and non- qualified annuities along with your qualified plan savings.

Additional strategies such as a 401(h) for small business owners, reverse mortgages, and life insurance loans should also be discussed with a financial professional. However, the core strategies outlined in this paper for using a Roth, an HSA, and an annuity are the most common steps individuals can take to position their retirement savings to deal with health care costs in a tax-favored manner. Whether you are accumulating wealth for retirement or managing income during retirement, be sure to take the time to review the benefits and costs of this approach with your tax and financial professionals.

Using a Roth, an HSA, and an annuity are the most common steps individuals can take to position their retirement savings to deal with health care costs in a tax-favored manner.

The Guardian Life Insurance Company of America guardianlife.com New York, NY

EB017930 (01/22)

2022-132273 (Exp. 01/24)

This piece was created with the help of Peter Stahl, a Certified Financial Planner™ with over 30 years of experience. He delivers training and resources across the United States, making navigating through a complex and ever-changing health care landscape comprehensible to all. Peter founded Bedrock Business Results LLC, a consulting firm, and WealthWatch, an online resource center providing content on retirement health issues (www.yourwealthwatch.com). He is the author of “Top of the First: The Convergence of Health Care and Financial Planning.”

In a good economy, smart business owners know that a benefits package needs to fan a candidate’s excitement for joining the team. Serving up the usual can do just the opposite, driving a strong potential employee into the hands of a competitor. A diverse team will have a diverse set of needs, so choosing benefits that match can identify your business as one that doesn’t just compensate talented individuals, but cares for them as well. And remember, a financial professional can help ensure that you pick benefits with the most value for your business.

Dental benefits

83% of US workers say their oral health is very important to them while nearly a third of US workers (30%) say the COVID-19 made them value their dental coverage even more.1 Appreciation for dental benefits increased for many Americans as a result of the pandemic. Recognizing this, most employers who plan to change dental benefits plan to increase them.1 Dental care is at least an annual expense for most people, and a young, healthy person may see their dentist more often than their doctor. Some group dental plans even offer ancillary perks like college tuition benefits (to retain or gift), meaning they can serve a range of needs in a single plan. Your diverse team members will appreciate the flexibility.

Help with financial priorities

Different generations have different priorities and timelines to follow. Younger generations are passionate about saving money, but don’t always know where to begin. Having a job, even a good job, doesn’t mean they’re not living month-to-month. Other generations worry about retirement planning. This kind of anxiety is not good for morale or productivity. Offering access to a financial professional can give employees much-needed knowledge about how to manage the money they’re earning.

Income protection

Income protection, also known as disability benefits, can be a powerful way of helping your employees feel confident and motivated. Often, employees don’t realize that protecting their income is key to their financial health, and they may not be aware that employers can provide income protection beyond their paychecks. Offering this protection, beyond the group minimums, can be a strong incentive to stay at a company, especially as a worker ages and the risk of long-term illness increases.

Wellness programs

A busy work life often makes it hard to live a balanced lifestyle. Long hours can make it harder to get to the gym or cook healthy food. Employees will appreciate a company that offers a helping hand in their quest for health, whether it’s a smoking cessation program or a benefits package that rewards them for hitting their step goals.

Student loan assistance

Amid rising education costs, it’s common to find employees who are struggling to pay off student loans. Since a distracted employee is a less productive employee, alleviating these kinds of worries can even benefit your bottom line. A benefits package that matches employees’ monthly loan payments, or pays a fixed sum each month, is immensely attractive to young professionals who are looking for a way out of debt as well as a great company to work with.

Generous parental leave

The United States is the only industrialized, modernized country that does not have a paid family medical leave program in place.2 A more generous, family-focused, “European-style” leave policy can signal that you’re a forward-looking, egalitarian workplace. Parents who get paid leave are more likely to continue their careers, allowing you to continue reaping the benefits of their experience and training.

Transit passes and gas cards

Commuting can be an expensive and time-consuming way to start your day. You can’t shorten the trip, but you can reduce the expense by including a pre-tax transit or gas payment card in your benefits package. For many employees, the goodwill you’ll create is at least as refreshing as a cup of coffee!

Tax assistance

Taxes are inescapable, but filling out all the paperwork yourself is still optional. Access to — or a discount on — tax preparation is a benefit that will be worth its weight in gold to many employees. They can use the benefit directly every April, and you can leverage a tax assistance benefit as an opportunity to educate them on the other tax-advantaged programs your company may offer.

Whether you are considering starting, expanding, or redesigning a benefits program, a financial professional can help you create a program to meet the needs of your diverse team. While not every benefit listed here is appropriate or affordable for every business, even adding one or two can make your company a more attractive workplace.

Brought to you by The Guardian Network © 2020, 2022. The Guardian Life Insurance Company of America®, New York, NY.

Guardian, its subsidiaries, agents and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

2022-144639 Exp. 10/24